What you’ll need to know about the new reporting requirements.

On July 22, 2016, the Director of the Financial Crimes Enforcement Network (“FinCEN”), U.S. Department of the Treasury, issued a Geographic Targeting Order (“Order”) to selected “Covered Business” entities that include all title companies. As a “Covered Business,” the order imposes new reporting requirements starting on August 28, 2016 if the specifics of the transaction meet the criteria of a “Covered Transaction” as defined in the Order.

WHAT ARE COVERED TRANSACTIONS?

While the Order is more comprehensive than this summary, three of the specific criteria are:

- That the property use is residential;

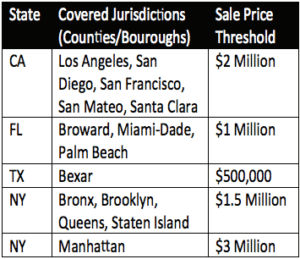

- That the location is in any Borough of New York or a designated County of California, Florida or Texas. California counties include Los Angeles, San Diego, San Francisco, San Mateo and Santa Clara;

- That the sales price meets a designated threshold, $2,000,000 in California.

WHAT DOES THIS MEAN FOR OUR BUSINESS PARTNERS?

For the duration of the Order, Title Preliminary Reports on residential property meeting the sales price and location criteria in the designated Counties/Boroughs will contain a new requirement or exception stating:

“This transaction may be subject to the FinCEN Geographic Targeting Order affecting residential sale transactions. This issuing agent must be provided with information prior to closing sufficient to determine if IRS/FinCEN Form 8300 must be completed and filed, and must be provided information sufficient to meet the records retention requirements of the FinCEN Geographic Targeting Order. This transaction will not be insured, and this issuing agent and/or its underwriter will not be involved in a Covered Transaction (as defined by the FinCEN Geographic Targeting Order) until this information is submitted and reviewed by the issuing agent.”

To comply with the requirement/ exception, we may need to obtain additional information about the transaction from other parties involved in the transaction. If we cannot obtain that information, we will be unable to close the transaction and issue a title insurance policy.

As your provider of title insurance, it is important to us that you are informed about this change in procedures and we will be following up with you in the near future regarding specifics for our transactions.

If you have any questions, please do not hesitate to contact us.

View the Order: Click Here